Private Equity Is The New Hedge Fund

SEPTEMBER 9, 2016

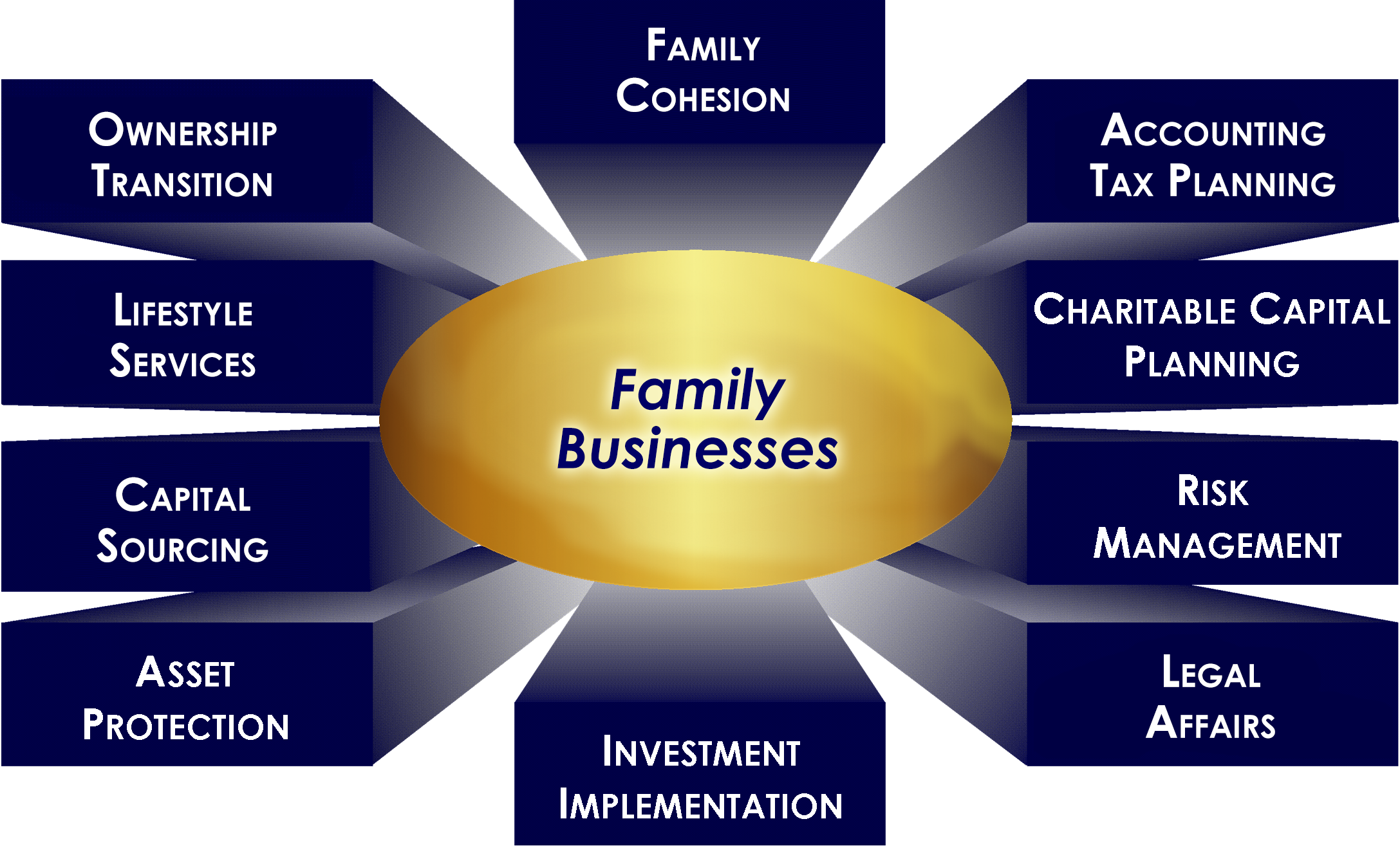

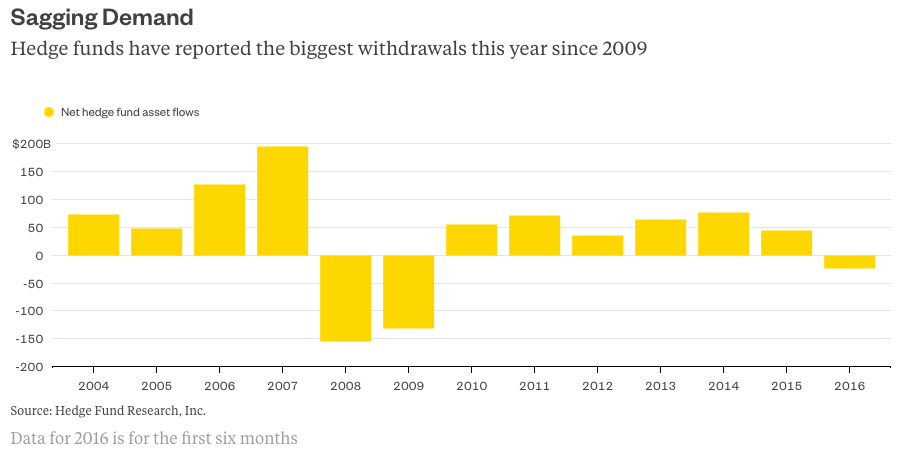

Hedge funds have served publicly as this year's whipping boy for angry investors. They've been hammered with some of the biggest withdrawals since the credit crisis and are being forced to drop their fees. Less discussed, however, is just how much private-equity funds have benefited from this. A UBS study published Thursday highlighted this shift in fortunes. About one-third of family offices surveyed have reduced their hedge fund allocations. They showed a particular distaste for credit and distressed strategies, especially after the energy-led corporate-bond selloff last year. But they found a deep affection for private equity.

A lot of money has come out of hedge funds this year, with eVestment reporting last month that withdrawals have totaled $55.9 billion. While it's difficult to say where all the cash is going, UBS's survey gives some clues about its direction.

Among these family offices, which have an average of $750 million under management, 29 percent said they planned to increase their allocations to private-equity funds, and 40 percent plan to boost their investment in direct venture capital and private equity.

Private equity funds aren't cheap. But they have a bunch of things going for them right now that hedge funds don't. The biggest draw is their returns, which have generally been terrific over the past few years. Some 89 percent of investors felt that private-equity investments have met or exceeded their assumptions, according to a Preqin investor outlook released Thursday. Private equity funds focused on direct lending, for example, have had average annual returns that have generally been above 10 percent, especially those started before 2012, Preqin data show. Those started in 2013 have generated average gains of 6.5 percent a year.

Also, for family offices, it's easier to understand what private-equity funds do. They invest in companies and real estate. They typically have longer investment periods, so they can plow into private markets and hang onto infrequently traded assets without worrying about having to sell them quickly to meet withdrawal requests. These funds also typically take a more hands-on approach with the companies they invest in.Hedge funds, on the other hand, are struggling to redefine their pitch. Once upon a time, they were the highflying risk takers. Then, after the financial crisis, they pitched themselves as a way to guarantee returns regardless of broader market moves. Yet returns have generally lagged behind broader benchmarks, with some funds experiencing big losses. This has been especially disappointing given that many funds still charge clients according to the classic "2 and 20" fee structure, or a 2 percent flat fee on assets and 20 percent of profits. Some 79 percent of investors don't think that hedge funds have met their returns expectations in the year through June, the Preqin report showed.

Whether private-equity funds can continue their stellar performance remains to be seen. Corporate valuations are high. Yields are low. A lot of investors are piling into real estate and illiquid private debt. The more crowded funds get, the more they'll suffer from the same fate as hedge funds, which ended up chasing after a lot of the same trades and getting burned for it.But for now, this is the hot spot. Private equity looks a lot like last decade's hedge fund.

Lisa Abramowicz is a Bloomberg Gadfly columnist covering the debt markets. She has written about debt markets for Bloomberg News since 2010.

This column was provided by Bloomberg News.