What should I know when it comes to financial planning for business owners?

© Yagi-Studio

Successful business owners usually understand the value of financial planning. Responsible both for their families and their business’ finances, We believe many have experienced the benefits of executing a well-crafted plan. They may also likely understand the downside of having a plan go awry or, worse, having no plan at all.

Still, the idea of financial planning for business owners has evolved over time, in our opinion. So, if you happen to be a successful business owner, this article may provide insights about and beneficial ways of approaching financial planning.

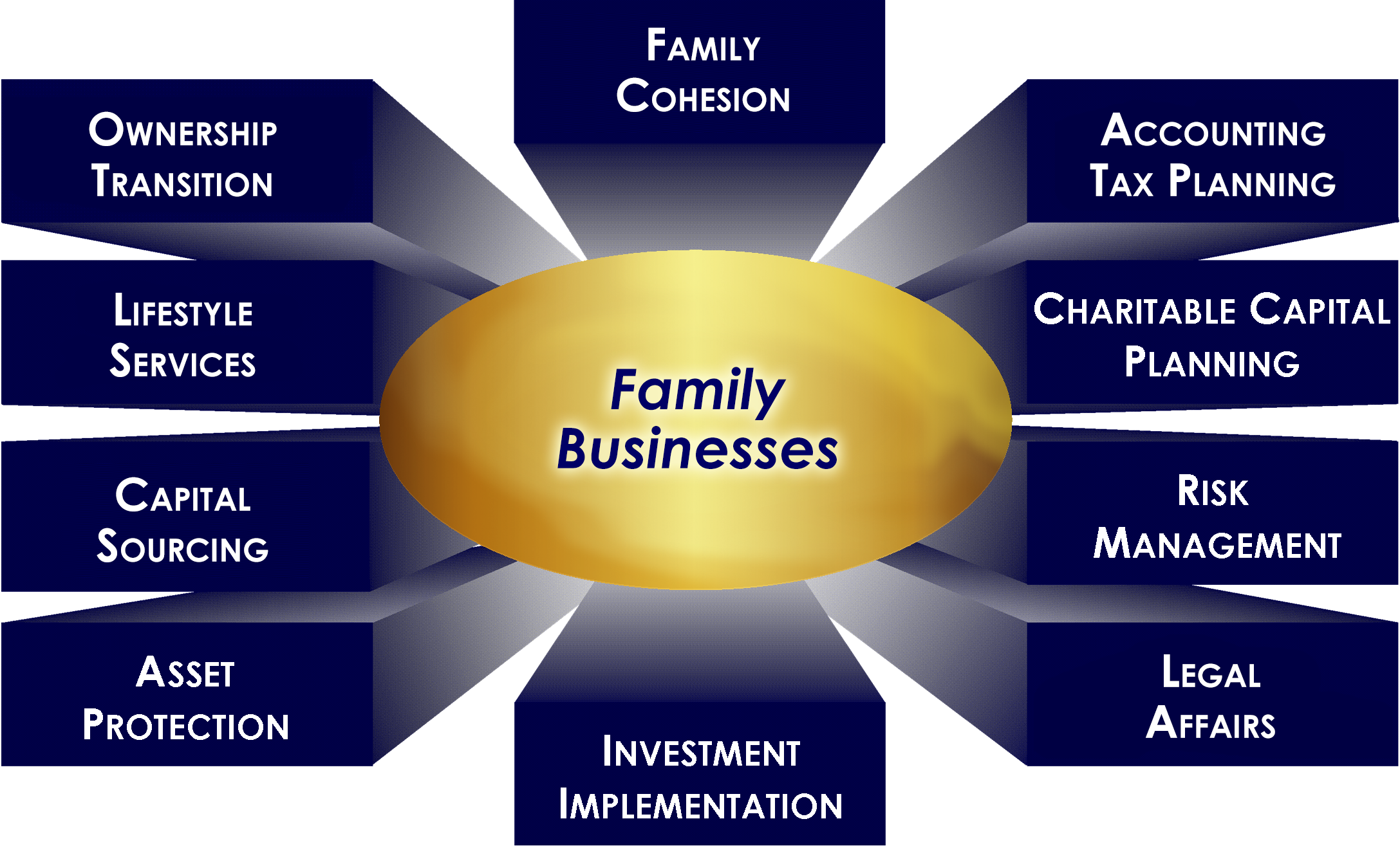

The specialty of wealth management, which is best suited for affluent individuals or families, expands upon financial planning’s purview to include the many factors, financial and nonfinancial, tangible and intangible, that constitute a family’s overall wealth. Wealth management therefore delves into such advanced planning topics as how to help enhance and preserve wealth, how to help protect a family’s assets and insure against potential risks, and how to best implement any charitable intention.

Also, while some financial planners may have helped facilitate a good estate plan and supporting documents, wealth managers consider an even wider array of life-planning documents.

Wealth management for business owners includes what is found in simple investment plans as well as in comprehensive financial plans, yet it is even broader and more complex. It is broader, of course, because it focuses both on the personal and the business needs, goals and dreams of the business owner; and it is more complex in two ways.

First, it embraces a range of issues specific to businesses, including challenges for those in owner-occupied buildings, 401(k) and other retirement plans, health plans and business-succession planning.

Second, it’s more complex because some of these additional issues require the business owner to weigh the needs and interests of his or her own family versus those of employees and customers. As someone responsible for multiple constituencies, the business owner must understand and make decisions that may have legal, regulatory, financial and ethical implications.

The idea of financial planning for business owners has evolved over time.

When working with our team, Hudson River Partners at UBS Financial Services Inc., you may find the following attributes helpful:

1. An understanding of the purpose and evolution of financial planning

2. A systematic, customized and consultative process

3. An understanding of the advanced-planning areas

4. A commitment to implementation, client reporting and ongoing follow-up

At Hudson River Partners, we have a systematic, customized and consultative approach. The process begins with a discovery meeting, which takes about an hour and a half. At that time, the client is asked about goals and dreams, along with detailed information about family members and other relationships, including relationships with existing advisors, legal, accounting, insurance, etc.

Prior to the meeting, the client is asked to bring in as many of his or her important busi- ness and personal documents as possible.

Two weeks after the initial discovery meeting, an investment plan meeting takes place. Since an investment plan forms a comprehensive contact, it’s a core component around which additional planning is performed. If the investment plan meets with the client’s approval, a meeting is set, where a serious mutual commitment to move forward is made.

Kathleen Entwistle and Bryan Stephens are Financial Advisors with UBS Financial Services Inc., 61 South Paramus Road, Paramus, N.J. 07652 and 299 Park Avenue, New York, N.Y. 10171. UBS Financial Services Inc. financial advisors engage Worth to feature this article. In providing wealth-management services to clients, we offer both investment-advisory and brokerage services which are separate and distinct and differ in material ways. For information, including the different laws and contracts that govern, visit ubs.com/workingwithus. In providing financial-planning services, we may act as a broker-dealer or investment adviser, depending on whether we charge a fee for the service. Financial plans provided free of charge are a service incidental to our brokerage relationship and the service terminates upon delivery of the plan. We provide financial-planning services as an investment adviser for a separate fee pursuant to a written agreement, which details the terms, conditions, fee and scope of the engagement. Note that financial planning does not alter or modify in any way the nature of a client’s UBS accounts, his or her rights and our obligations relating to these accounts or the terms and conditions of any UBS account agreement in effect during or after the financial-planning service. Clients are not required to establish accounts, purchase products or otherwise transact business with us to implement their financial plan. Should a client decide to implement his or her financial plan with us, we will act as either a broker-dealer or an investment adviser, depending on the service selected. For more information about our financial planning services for a fee, please see the Firm’s Financial Planning Disclosure Brochure. UBS Financial Services Inc., its affiliates, and its employees do not provide tax or legal advice. Clients should speak with their independent legal or tax advisor regarding their particular circumstances. The strategies and/or investments referenced may not be suitable for all investors. UBS Financial Service Inc. is a subsidiary of UBS AG. Member, FINRA/SIPC.

This article was originally published in the August/September 2016 issue of Worth.

Knowledge Center

- Business Owner Blindspots

- Managing Risk

- Opinion: Looking for the Perfect Buyer?

- Proper Compensation Design Takes Effort

- The Benefits of Outside Directors in ESOP Companies

- The ESOP 1042 “Tax-Free” Rollover. It’s Back! Savings May Exceed 30%.

- What should I know when it comes to financial planning for business owners?