What’s the smartest form of charitable giving in an uncertain economy?

© Shutterstock

In the current economic environment, smart giving requires the same carefully constructed strategic thinking that you apply to the rest of your finances. Even during the 2008 recession, almost half of all donors made gifts at the same level as in years past, with 26 percent of donors actually increasing their gift levels.1

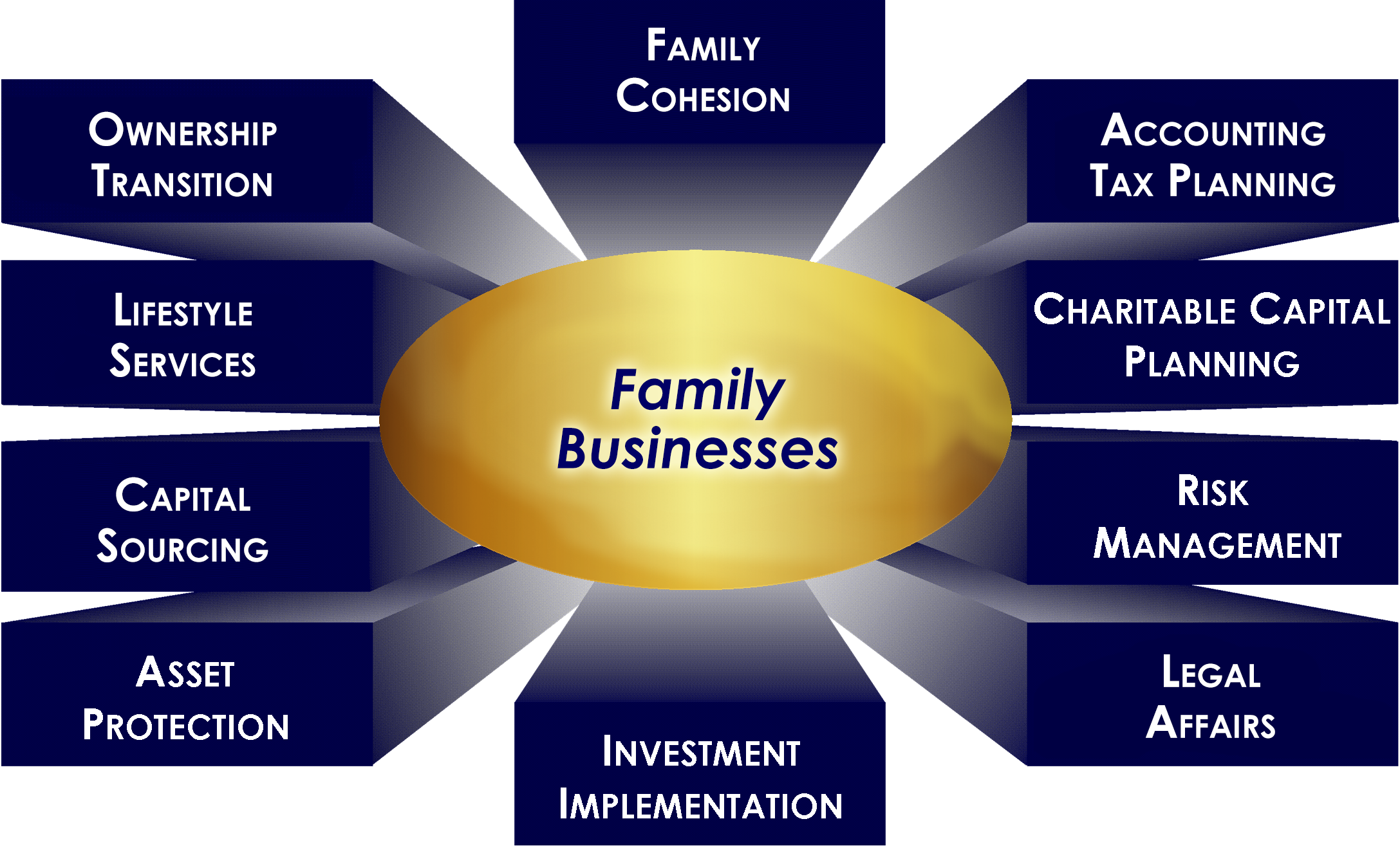

As advisors, we work to make sure that your philanthropic efforts are aligned with your other financial strategies, so that your charitable aspirations aren’t fulfilled at the expense of other important objectives, and vice versa.

Here, we might cite the fact that most people practice a form of “checkbook philanthropy,” which involves simply writing checks regularly to a particular organization, or randomly in response to requests from multiple organizations and individuals. Yet, while donating cash is simple and straightforward, it doesn’t always offer optimal tax advantages.

Instead, donating appreciated securities— instead of selling the securities first, paying capital gains tax and then contributing the proceeds—may be a better alternative. That way, if your designated charity sells the stock after it receives the donation, as a tax-exempt organization, the charity will not pay tax on the capital gains triggered by the sale.

In the current economic environment, smart giving requires carefully constructed, strategic thinking.

CHARITABLE GIVING VEHICLES

Besides understanding the smartest way to donate—whether that entails cash, securities or tangible assets like cars and art—another major issue to consider is how. You may choose to give to charity outright or donate through a charitable vehicle, such as a donor advised fund, private family foundation, charitable trust, gift annuity or pooled income fund. All offer various tax benefits but differ in their structure and administrative requirements. Three of the most common are:

- Donor advised funds: Donor advised funds, the fastest growing form of philanthropy, offer a simple and organized way to give. Donors make tax-deductible contributions of cash or securities to the fund and can direct the fund to make grants to charities of their choice. Contributions are invested and professionally managed, giving donors the potential to have their contributions grow, and to make larger grants over time.

- Charitable trusts: Charitable trusts offer an immediate income tax deduction and can be structured to provide an income stream to either the donor or the charity. Charitable remainder trusts allow the donor to transfer assets to the trust and receive payments for a certain term, with the charity receiving any remaining assets at the end of that term. Charitable lead trusts pay the income stream to the charity, with any remaining assets in the trust passing to the donor’s heirs free of gift and estate taxes.

- Private foundations: Private foundations are often established with larger donations by an individual or family, to further a charitable purpose. They offer donors control over grants and a way to encourage heirs to get involved in philanthropy. Private foundations, however, can have high administrative costs, offer a more limited income tax deduction and require an annual distribution to charity of 5 percent of the foundation’s assets.

If you consider yourself a checkbook philanthropist or just want to know how to get more out of your charitable giving, let’s talk about ways to make your philanthropy more organized and effective.

1“Issues Driving Charitable Activities Among Affluent Households,” The 2008 Study of High Net Worth Philanthropy. Center on Philanthropy at Indiana University. Study sponsors: the Bank of America and Merrill Lynch, March 2009.

This article has been written and provided by UBS Financial Services Inc. for use by Jesse Rodriquez, President—Wealth Management with UBS Financial Services Inc., a subsidiary of UBS AG. Member FINRA/SIPC in 888 San Clemente Drive, Newport Beach, CA, 92660. UBS Financial Services Inc. Financial Advisor(s) engaged Worth to feature this article. As a firm providing wealth management services to clients, we offer both investment advisory and brokerage services. These services are separate and distinct, differ in material ways and are governed by different laws and separate contracts. For more information on the distinctions between our brokerage and investment advisory services, please speak with your Financial Advisor or visit our website at ubs.com/workingwithus. UBS or legal advice. These materials and any tax related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

This article was originally published in the June/July 2016 issue of Worth.

Knowledge Center

- 'Entrepreneurial' Philanthropy Focuses On Results

- Can I boost the impact of my giving with strategies similar to those I use in my business?

- How can I make philanthropy a family activity?

- Nonprofits Are Seeking Profits

- Recent Estate And Gift Tax Changes Require Immediate Action

- The Evolution of Charitable Capital Planning

- The Power of Gift Annuities

- What’s the smartest form of charitable giving in an uncertain economy?

- Why is cost basis important for investors to understand when considering gifting strategies?